Tokyo stocks tumbled Thursday, with the Nikkei index briefly sliding over 3 percent, on growing concerns over Japanese corporate earnings prospects as the yen climbed sharply following the Bank of Japan's interest rate hike.

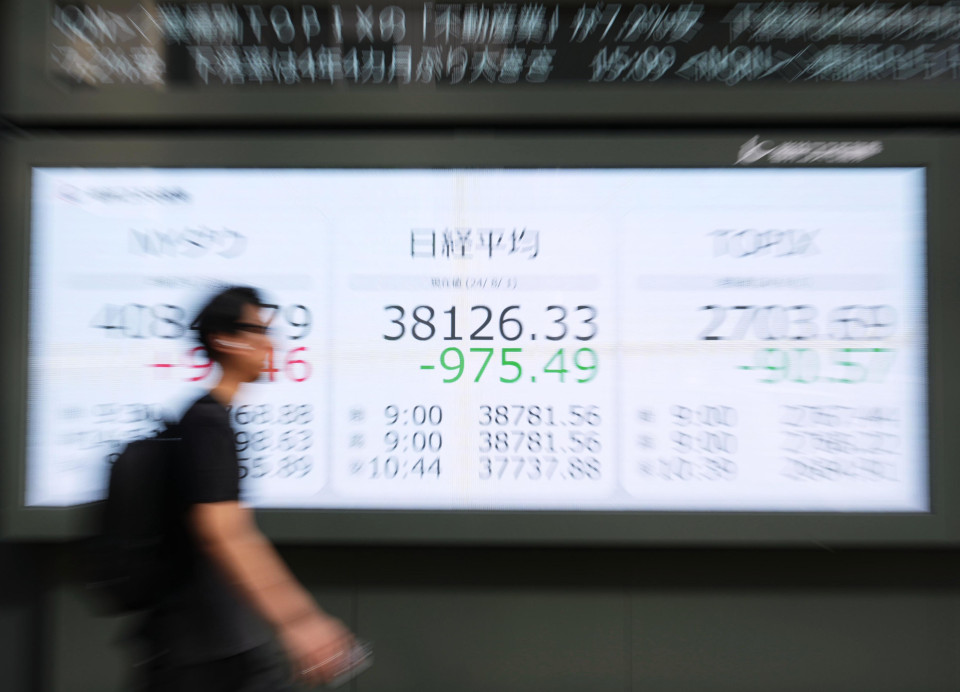

The 225-issue Nikkei Stock Average ended down 975.49 points, or 2.49 percent, from Wednesday at 38,126.33. The broader Topix index finished 90.57 points, or 3.24 percent, lower at 2,703.69.

Every industry category on the top-tier Prime Market lost ground, led by real estate, transportation equipment and insurance issues.

The yen strengthened to 148.51 against the U.S. dollar, a level unseen over the last four months, before fetching 149.85-87 yen at 5 p.m., compared with 149.91-150.01 yen in New York and 150.90-92 yen in Tokyo at 5 p.m. Wednesday.

The Japanese currency has surged since BOJ Governor Kazuo Ueda signaled Wednesday the central bank might raise interest rates further this year at a time when the U.S. Federal Reserve is seen as on course to cut rates in September.

The euro was quoted at $1.0801-0802 and 161.86-90 yen against $1.0820-0830 and 162.43-53 yen in New York and $1.0817-0818 and 163.23-27 yen in Tokyo late Wednesday afternoon.

The yield on the benchmark 10-year Japanese government bond ended at 1.030 percent, down 0.025 percentage point from Wednesday's close, tracking an overnight fall in long-term U.S. Treasury yields due to increased trader confidence in a Fed rate cut at its next meeting.

Stocks suffered heavy selling, with auto and electronics shares pressured by concerns that their overseas profits will be reduced by a stronger yen when repatriated, brokers said.

Real estate issues also lost ground on fears that the BOJ's rate hike would lead to higher mortgage rates and dampen housing demand.

"As there is still some distance between the current exchange rate and 143-145 yen expected by companies for this fiscal year, they are unlikely to see a decrease in profits at this point," said Shingo Ide, chief equity strategist at the NLI Research Institute.

But hopes for higher earnings when the dollar had been exceeding 160 yen "have receded considerably," he added.

Related coverage:

Yen jumps to 149 zone vs dollar after BOJ rate hike, governor remarks

Japan confirms 5.53 tril. yen spent on forex intervention in June-July