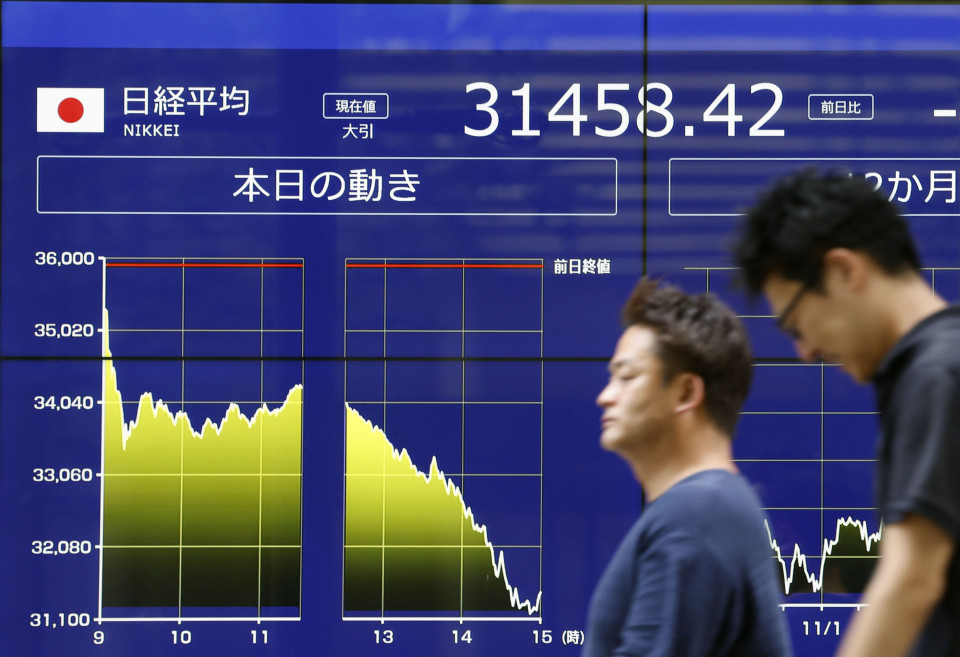

The Nikkei stock index closed with its largest single-day point drop in history on Monday, tumbling over 4,400 points and 12 percent, in a global market crash amid a firming yen and escalating fears of a U.S. recession triggered by disappointing economic data.

The U.S. dollar plunged briefly by nearly 5 yen from late last week to a fresh seven-month low of 141.69 amid growing speculation that the Federal Reserve will cut interest rates significantly in September. It later returned to the mid-143 yen level on buybacks.

The 225-issue Nikkei Stock Average ended down 4,451.28 points, or 12.40 percent, from Friday at 31,458.42. The broader Topix index fell 310.45 points, or 12.23 percent, to 2,227.15. The figures marked the lowest closes for both indexes since October last year.

Every industry category on the top-tier Prime Market lost ground, led by insurance, bank and securities house shares.

At 5 p.m., the dollar fetched 143.47-52 yen compared with 146.43-53 yen in New York and 149.20-23 yen in Tokyo at 5 p.m. Friday.

The euro was quoted at $1.0948-0950 and 157.10-14 yen against $1.0905-0915 and 159.82-92 yen in New York, and $1.0804-0805 and 161.21-25 yen in Tokyo late Friday afternoon.

The yield on the benchmark 10-year Japanese government bond briefly fell 0.205 percentage point from Friday's close to around a four-month low of 0.750 percent, as investors bought the safe-haven asset amid tumbling Tokyo stocks and U.S. long-term Treasury yields. It ended at 0.755 percent.

Stocks plunged from the outset and continued to deepen their losses in the afternoon, with the Nikkei's decline eclipsing the 3,836-point drop registered on Oct. 20, 1987, the day after the Black Monday stock market crash.

The benchmark marked the second-largest percentage drop on record since the 14.9 percent plunge on the day after the Black Monday sell-offs.

The steep falls triggered a stock circuit breaker for Topix and Nikkei futures, temporarily halting trading. The step was taken for Topix futures for the first time since March 15, 2011, four days after a powerful earthquake hit northeastern Japan.

After ending the previous trading day down 2,216.63 points, the benchmark lost further ground on Monday, briefly falling over 4,700 points. Its latest closing level was 25 percent lower than its all-time closing high of over 42,000 on July 11.

The market was hit by a "triple punch" of disappointing U.S. economic data stoking recession fears, the Bank of Japan's sudden decision to hike interest rates, and the perception that the artificial intelligence bubble may have popped, analysts said.

"It is not just an issue in Japan but a worldwide crash, reflecting the bursting of an asset bubble inflated by excessive post-COVID monetary easing," said Tomoichiro Kubota, senior market analyst at Matsui Securities Co.

The risk-off mood has spread globally, with stock markets in Taiwan and South Korea also closing at steep drops of over 8 percent on Monday.

Investors unloaded technology shares as "high expectations for AI have deflated after (disappointing) quarterly earnings reports from U.S. companies," said Kubota.

Meanwhile, the BOJ's shift away from monetary easing has ended "an era of zero interest rates" and led the yen to appreciate, putting pressure on exporters as it reduces their overseas profits when repatriated, analysts said.

Bank and finance-related stocks were among the day's biggest losers as a decline in Japanese and U.S. long-term interest rates dampened expectations for improved profitability among financial institutions.

Related coverage:

FOCUS: Japan faces economic stagnation as stocks plunge after rate hike

FOCUS: BOJ's perceived hawkish tilt to be tested after rate hike